Shipping and the Policy Minefield

- Mark Williams

- Nov 5, 2025

- 6 min read

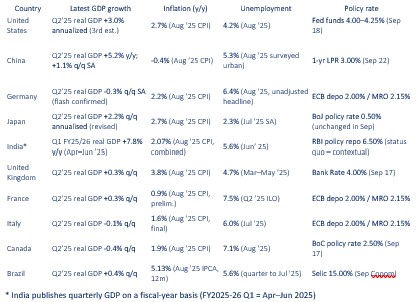

The regular macroeconomic data tell a tale of more of the same. US data shows upgraded Q2 GDP growth of 3.0% annualised, inflation of 2.7% unemployment of 4.2% and a cut in the Fed Funds 25 basis points to a range of 4.00% to 4.25%, since cut by a further 0.25%. Chinese GDP growth in Q2 was 5.2%; August inflation was -0.4%, August unemployment was 5.3% and the 1 year policy rate in September was 3.0%. In Japan, GDP growth for Q2 has been revised up to 2.2%; inflation was a 2.7% in August, unemployment was 2.3% in July (latest data) and the BoJ policy rate remained 0.5% in September. As one goes through the top ten global economies, the picture is mostly one of positive if weakening growth data and policy steadiness among central banks.

Macro Dashboard At 30 September 2025

This steady-state model is at odds however with increasing anxiety over national debt levels. In the US, the government has faced one of its increasingly regular stand-offs over funding. One assumes that the MAGA Republicans would be happy to see much of the state be stood down indefinitely anyway. US 10 year treasury yields are steady this year at a little over 4% but the interest rate has doubled since 2022. In Japan where the ruling LDP is undergoing a leadership contest after losing badly in mid-term elections, the bond markets are worried about the expansion of government spending, which has led to calls for a second budget this year. The 30 year bond yield moved to all-time highs in September. After years of loose fiscal policy, inflation is now becoming problematic and Japan’s vital auto industry faces headwinds from Chinese competition and US protectionism.

In Germany, as across the EU, regulatory burdens and international competition are eating industry up at an alarming rate. Germany has faced over 30,000 auto industry redundancies in the last 12 months. Its big car makers cannot force buyers to take their expensive EVs; instead, consumers choose cheaper Chinese models. Meanwhile EU environmental regulations are phasing ICE cars out by 2035 but the infrastructure to switch to EVs is unlikely to be sufficient by that date. German government bond yields, meanwhile, have tracked those in the US, bottoming out during COVID at negative levels, but rising closer to 3% in the current year, a level last seen in the midst of the 2008 financial crisis. Germany’s debt to GPD ratio, basis IMF data, is 62.66%, so how worried should bond investors be about France (110.64%) or Italy (134.79%) or the UK (101.15%), Canada (107.49%), the US (123.0%), and of course Japan where the debt to GDP ratio is 249.7%?

As governments take on higher costs, they have to raise the funds to pay for things. The orthodox view is that there are two ways to fund governments: debt and tax. Successful city states like Singapore or Dubai also have governments that own income-generating assets, but let’s put that to one side for now as it is politically impracticable in most OECD nations for the state to start buying assets and renting them out to the voters. Meanwhile, tax rates have been heading one way for years in most countries, which is of course one reason why Mr Trump has won his second term and his stated reason for imposing tariffs is to fund tax cuts. In some countries like the usually mild-mannered UK, the locals are becoming increasingly restive about the increasing tax burden and the increasing benefits (entitlements) costs – money said to be spent on shirkers and bogus asylum seekers.

The problem for politicians is that, to appease the bond markets they have to tax-farm their middle classes, which makes them politically unpopular. The UK’s current prime minister is the least popular on record, only 15 months into the job, a personal tragedy for a man whose main electoral attraction was the characterless technocratic managerialism he offered after the personality politics of the previous increasingly farcical Tory government. France has been hiring and firing prime ministers like football club coaches. Italy looks like a bastion of political stability under Georgia Meloni, more so since her party won the regional election in Italy’s central province of Marche with more than 50% of the vote. Her next challenge is to achieve EU approval for her plan to bring Italy’s budget deficit back within EU limits; she seems to be in favour in Brussels.

As governments of the left and right sacrifice their principles on the alter of global markets, there is a growing discourse about radical change to how countries are run, to who should own assets and who should pay taxes. The US is well ahead of the race but is far from alone. Throughout the OECD, policies that were until recently considered far-right are now within the so called Overton Window of acceptable political discourse. In the UK, the Labour government’s Chancellor has repeatedly rejected any notion of wealth taxes, while in France a plan to tax at 2% all fortunes over €100 Mn is grinding its way through parliament. The UK’s most popular political party is currently the far-right Reform, branded racist by a Prime Minister who has effectively cast 38% of voters beyond the pale.

This is suddenly affecting shipping, with the likes of CMA-CGM’s Saadé family firmly in the cross-hairs of France’s wealth tax. As governments scramble to raise money, the cat’s cradle of non-dom tax arrangements, offshore incorporation, and the difference in tax treatment between capital gains, carried interest, dividends, and income are all coming into question in various jurisdictions.

The EU of course is ahead of the curve on shipping taxation with the introduction of shipping into its emission trading scheme and the new FuelEU Maritime regulations which came into force this year. These regulations aim to force ship owners to use renewable fuels of non-biological origin (RFNBO) through a carrot-and-stick approach. Use 2% RNFBOs across a pool of vessels, and taxes are negligible. Miss the hurdle and taxes are painfully high. This is supposed to encourage the use of RFNBOs but does nothing to encourage their production. Ship operators who mostly or entirely operate within the EU are at a sudden disadvantage to those who operate elsewhere. There is talk of two-tier markets and the regionalisation of trade, as shipowners set their legal advisors to build a league table of more suitable locations to operate.

In the US, the tech visa application fee that has just been introduced will not bother Amazon or Apple but it might prevent start-ups or scale-ups from accessing lower-cost and highly motivated candidates, and thus might be a bloc on entrepreneurship. In the UK, swingeing cuts to tax-free dividend caps and rising employment taxes are killing off entrepreneurship and culling vacancies among larger employers. The Labour government demonstrated its level of commitment to the shipping industry by making its youngest and least experienced member of parliament the new Shipping Minister.

One of the few outliers is Greece. At the end of 2022, article six of the new law 5000/2022 cut in half to 5% the “voluntary” contribution payable to the Treasury by the Greek Maritime Community. Payment of the voluntary contribution negates any other Greek tax obligation on the world-wide income of the beneficial owners of any company that falls under the scope of the law. The scope of the law was also extended to cover time chartered as well as owned ships so long as 25% or more of the fleet is EU-flagged and so long as no more than 75% of the fleet is time chartered.

The increase in the Greek Maritime Community in the last two years has been particularly notable in one respect, namely the number of shipbrokers who are moving to Athens and its suburbs. 2024’s Posidonia was one of the biggest ever with a record attendance. Posidonia 2026 seems certain to exceed it in scope and numbers.

Politics around the world is increasingly becoming about identity, differentiating between “us” and “the other”, and declaring whether individuals or corporates are in the club or not. Rather than seeking consensus and unity, politicians increasingly seek scapegoats and shills they can shake down for money. Even shipping has been affected, with sanctions resulting in the advent of a shadow fleet of tankers representing as much as a quarter of the globally available deadweight. As the US derogates the IMO carbon levy, as the EU tries to push the agenda on global shipping regulation, as China tries to impose the supremacy of its nine-dash line over UNCLOS, individual ship owners have to navigate not only around war zones, storms and geographic bottlenecks, but increasingly around unpredictable and geographically distinct legal, fiscal and regulatory regimes.

Great writing as ever Mark. I guess that one of the joys and challenges of being a ship owner or operator is navigating these ever changing regulatory environments. Until a somewhat clearer way forward emerges - in bulk trades, the fleet gets older and subsequent opportunity when we get a new super cycle grows. Perhaps a when ? Not if …!!